Posts by Alegria Network Administrator

Social Security Tax Update: How High Can It Go?

Employees, self-employed individuals and employers all pay the Social Security tax, and the bite the Social Security tax takes gets bigger every year. Here’s what you should know — and why you should be concerned. Projected Social Security Tax CeilingsThe Social Security tax hit on your income is expected to get much worse in future years, according…

Read MoreHelp Wanted: Hiring Your Kids to Work for Your Small Business

If you own a small business, you might consider hiring your kids to work during their time off from school. In addition to teaching your children some financial responsibility and business sense, there are some tax advantages to factor into your decision. Here are the details. Tax Advantages for Your ChildThere are special tax breaks for…

Read MoreUse Overtime Prudently or You’ll Incur Major Risks

When companies depend on overtime to meet productivity goals, they can’t ignore or minimize the stress and disruptions it causes in their workers’ lives. The risks — especially now that so many employees have made it clear that they’ll voluntarily leave their jobs — are too great.What’s more, if a business becomes overly dependent on overtime,…

Read MoreConsider Tax Issues When Valuing a Business for Divorce

Let’s say divorcing spouses own part of the stock in a closely held corporation. This may be one of their biggest marital assets, and often one spouse decides to buy out the other party’s shares by transferring some assets in exchange for the stock. Before jumping headfirst into these transfers, it’s important to consider the expected…

Read MoreDos and Don’ts for Business Expense Deductions

As tax season heats up, companies of all kinds and sizes will be on the hunt for ways to reduce their tax bills. One of the most common ways is through business expense deductions, but not every such expense is deductible. Here’s what to know about the expenses that you can — and can’t — properly…

Read MoreWhat Happens When the Department of Labor Audits an ERISA Plan?

Question: Our organization sponsors both health and retirement plans that must comply with the Employee Retirement Income Security Act (ERISA). We recently received a request from the U.S. Department of Labor (DOL) for plan-related documents. Is this an audit? And if so, what should we expect? Answer: A request for plan documents usually signals the beginning of…

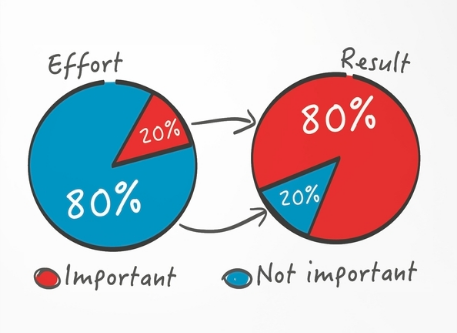

Read MoreDistinguish Your Company’s Elite: Follow the Pareto Principle

Even in America, not all customers are created equal. If you apply the “Pareto Principle” to your sales department, you’re likely to make two discoveries: 80% of your Without a strategy for concentrating on your trophy clientele and putting the rest on the back burner, you could be spinning your wheels to meet the demands of…

Read MoreHow Intended Uses May Affect an Expert’s Value Conclusion

What is the value of my business? That’s the question every business owner wonders from time to time. But the correct answer varies depending on the purpose of the appraisal. Different rules and “standards of value” may apply depending on how the report will be used. Fair Market ValueIn the United States, the most widely recognized and…

Read MoreFamily and Medical Leave: Does Your Program Qualify for the Tax Credit?

In a tight labor market, paid family and medical leave is rapidly becoming more of an expected benefit than just a perk. The good news is the Section 45S federal tax credit for family medical leave programs can help your organization recruit and retain skilled workers while also cutting your tax bill. Here’s what you need…

Read More6 Tax Angles to Layoffs

After a robust job market over the last few years, layoffs are now on the rise. Through November 2023, employers have announced nearly 690,000 job cuts this year, an increase of 115% over the same period last year, according to outplacement firm Challenger, Gray & Christmas. This is the highest January-through-November total since 2020. Prior to…

Read More