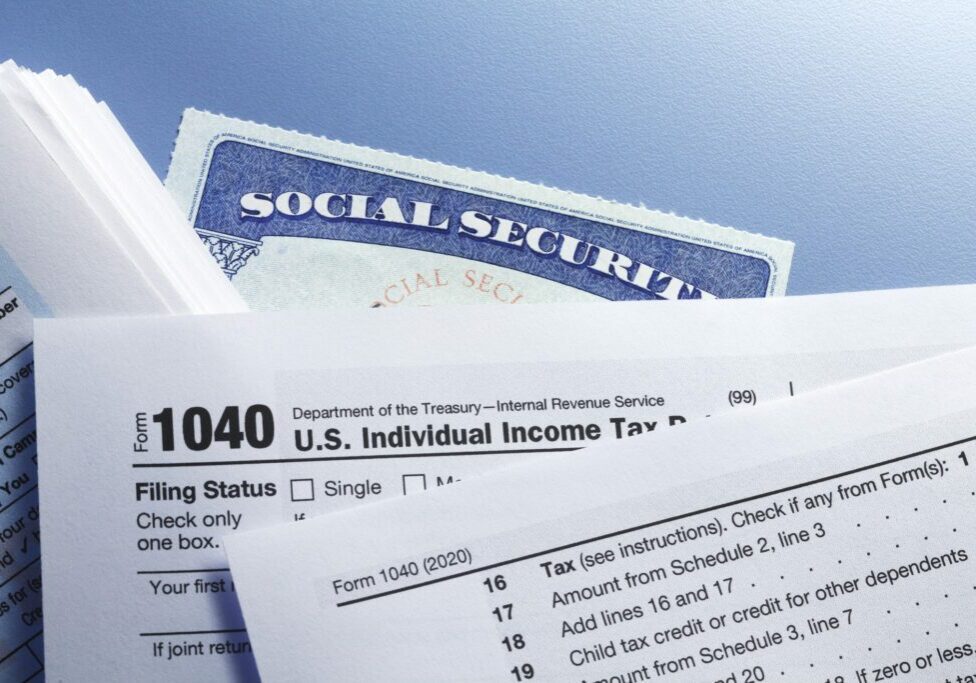

Taxpayer Identity Theft

As the 2015 tax filing season starts, the nation’s fastest growing crime involves stealing taxpayer Social Security numbers to file for false refunds. Taxpayers who are unlucky enough to be the victim of this growing threat face headaches in filing their returns and dealing with IRS notices as well as significant delays in resolving the issue and receiving a refund if one was due. In fact, while the IRS states that it will normally take 180 days to resolve taxpayer identity theft cases, recent research shows the true resolution time is closer to 280 days.

What is Taxpayer Identity Theft?

Taxpayer identity theft is when someone uses a stolen social security or taxpayer identification number to file a false tax return to claim a fraudulent refund. According to the General Accountability Office (GAO), the IRS paid out 5.8 billion dollars in false refunds to identity thieves for the tax year 2013. The real figure is probably significantly higher because of the difficulty of knowing how much income tax fraud goes undetected.

While the IRS and state revenue agencies have been working to identify ways to fight refund fraud, due to the fact that the IRS is under a competing priority to provide refunds to taxpayers quickly, significant opportunities still exist for refund fraud to occur. Often times, a taxpayer identify theft victim will not find out until they try and file their tax return, at which point it will be rejected as more than one tax return was filed using their SSN. However, other signs to watch out for include receiving IRS communications based on a tax return you have not filed or wages or other income showing up on a tax transcript or social security statement from an employer you did not work for.

What to Do?

Prevention is always the best medicine. Taking the appropriate steps to protect your personal information may not only save you from being the victim of taxpayer identity theft, but may also save you from other identify theft related issues.

- Do not routinely carry your Social Security card or any document with your SSN on it.

- Do not give a business your SSN just because they ask – only when absolutely necessary.

- Protect your personal financial information at home and on your computer.

- Check your credit report annually.

- Check your Social Security Administration earnings statement annually.

- Protect your personal computers by using firewalls, anti-spam/virus software, update security patches and change passwords for Internet accounts.

- Do not give personal information over the phone, through the mail or the Internet unless you have either initiated the contact or are sure you know who is asking.

Unfortunately, no matter how well you protect your information, it is unfortunately still too easy to become a victim of taxpayer identity theft. If this does happen, you should take the following steps immediately to help resolve the issue:

- File a police report and obtain a paper copy.

- File a complaint with the Federal Trade Commission.

- Contact one of the three major credit bureaus and place a “fraud alert”. Also, you may consider placing a security freeze with each bureau to eliminate the thieves’ ability to access your credit report.

- Respond immediately to any IRS notice and call the number provided.

- Complete IRS form 14039 Identity Theft Affidavit.

- Continue to pay your taxes and file your tax return, even if by paper.

About Alegria & Company, P.S.

We want to be your partner in success. Helping you with your financial needs is the perfect opportunity to do so. Our team of four partners and twenty-five professional staff located in two offices in Yakima and Prosser are well placed to serve clients from Yakima through the Lower Valley, the Columbia Basin and throughout the Pacific Northwest.